|

Rational Tariffs Lower Irrational Trade Deficits

As historical memory diminishes and

the lessons of past centuries are forgotten, the practice of systematically destroying economic independence grows. Forget

about real prosperity, the concept of interdependence, coined in popular parlances by the Trilateral Commission, has made

the United States economy a post industrial dependency and a bankrupt debtor. The global corporatists despise protective tariffs

because these excise taxes must be paid by foreign manufacturing enterprises. Since the rush to escape American shores, the

transnational ventures seek not just cheap labor, but scheme to evade any effective regulations for the paradise of third

world exploitation. America’s economy was built under the shield of tariffs. The nation became the greatest industrial

engine and traded profitably with the rest of the world, when reasonable excise and duties were charged on products entering

this country. Just remember, the budgets of government were paid without an income tax under this system of tariffs. Who can

logically argue that the deception of Free Trade benefits our population, when the current record of trade deficits continues

unabated? Tariffs for Survival

or Profits for Multinationals provides evidence that tariffs are the best method to combat the deficiencies

of the Free Trade ruse. "There

is nothing free about the loss of living wage jobs and the demise of independent production capacities. The notion that America

is best served when multinational 'stateless' corporations are allowed to leave our shores and dump their foreign built products

back upon the society that developed, financed and provided a ready market, is insane."

The mumbo jumbo of corporate economists, employed by financial institutions is nothing more

than jive by paid shills to defend an indefensible system. Use common sense. Any economy that is systemically stuck with mounting

trade deficits is going broke. As long as the American marketplace has the desire to buy foreign made products and the money

to pay for them, the game will last a little longer. However, as a nation,

the country is broke and the day when the dollar loses its reserve currency status is nearly upon us. Trading countries want

to sell their goods to Americans. These countries will continue to do so even after adding a fair excise tax for the privilege

of exporting their items to the largest market in the world. Yes, the

cost to consumers may rise, but the balance of deficits will fall dramatically and would push the buying power of the currency

higher, which will allow for purchases in more valuable dollars. The other worthwhile consequence is that offshore manufacturers

will want to build plants, create products and employ American workers here at home. The invigoration of domestic growth can

and would develop when the labor force is able to get back to work.

The

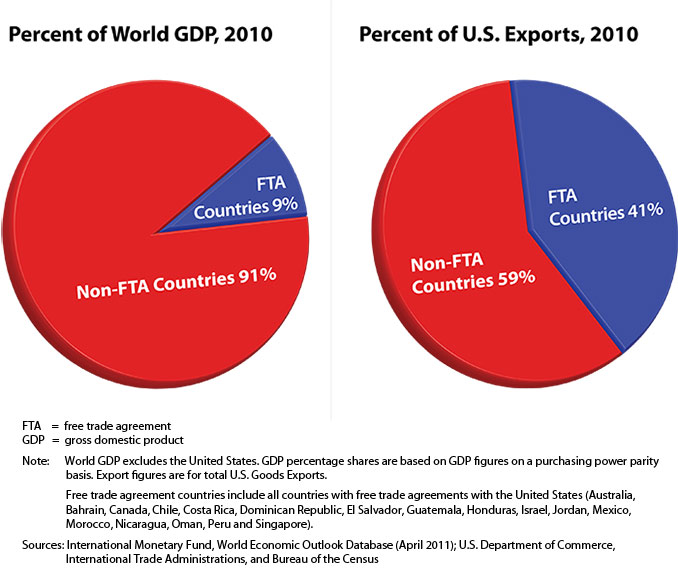

chart that shows world GDP when compared to trade under free trade agreements demonstrates that much of the world is not bound

to the restrictions that favor globalist enterprises. Then ask why is it so important for the United States to have free trade

agreements with other countries, which result in opening up our markets for dumping products that force out our own production

and close domestic businesses? The false argument that free trade and

a cheap dollar foster American exports is one of the most destructive myths that the corporatists spin. Domestic exports are a very low percentage of national output and even if the dollar was

to lose, 90% of its international exchange rate value products will not be exported because the country is phasing out most

manufactured goods. The notion that exporting our natural gas resources will help is extreme lunacy in an infinite asylum

of national denial. In the Varying Verity series the following, written ten years ago, remains true today. "The

method to adopt for restoring a viable domestic economy would require reforms that drastically lower, if not abolish, personal

income taxation - be linked to the passage of Pro-Competitive ad valorem Tariffs in the form of a national import sales tax.

We all share in the goal of smaller government, less regulation and free usage of our own money. We have a mutual interest

in building a domestic economy that will create higher wage scales and more retained after tax income for the greatest number

of our own population. When the best jobs become government work, our society is doomed and reduced to the median worldwide

income levels."

Surely, you must acknowledge that our

country is desperately in need of a dramatic job growth strategy. Hopefully you will accept that private employment enterprises

are preferable to public section government make work positions. Certainly you must see the sense in lowering the trade deficits

that are bankrupting our economy. Need more proof?

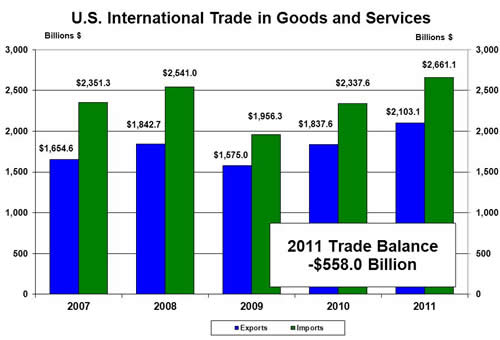

Look

at the steady rise in the trade deficit for the last two years. With a November 2011 trade deficit of -$47.8 Billion Dollars,

just how much of our wealth and resources need to be transferred overseas to narrow this real world wealth destroyer? The

answer is that the deficit curve will never turn down until rational protective tariffs are levied on imports. How can America exist as a viable economy, when our money sinks in purchasing power and

the country must import consumable goods, especially when we have no money to pay for the products? Obviously

going into further debt is no alternative if the economy is to survive. This current course guarantees a lower standard of

living and a dismal future for your children. Whenever the topic of establishing

reasonable protective tariffs comes up, you hear the claim that the Smoot-Hawley tariff of 1930 deepened the depression. Ian

Fletcher in Protectionism Didn't Cause

the Great Depression debunks this misnomer. "The Smoot-Hawley tariff was simply too small a policy change to have so large an effect

as triggering a depression. For a start, it applied to only about one-third of America's trade: about 1.3 percent of our GDP.

One point three percent! America's average tariff on goods subject to tariff went from 44.6 to 53.2 percent -- not a very

big jump at all. America's tariffs were higher in almost every year from 1821 to 1914. Our tariffs went up in 1861, 1864,

1890, and 1922 without producing global depressions, and the great recessions of 1873 and 1893 spread worldwide without needing

the help of any tariff increases. If Smoot-Hawley had caused a global

trade disaster, it would necessarily have been by triggering a sharp decline in American imports of goods subject to the increased

tariff. Did this happen? The data say no."

Do not be

deceived by the globalists. Sensible tariffs are a solution. Trade deficits are the problem. Liberate yourself from the Free

Trade agreements that only produce high unemployment and perpetual poverty. James

Hall – January 25, 2012

|