|

Individual Wealth in Perspective

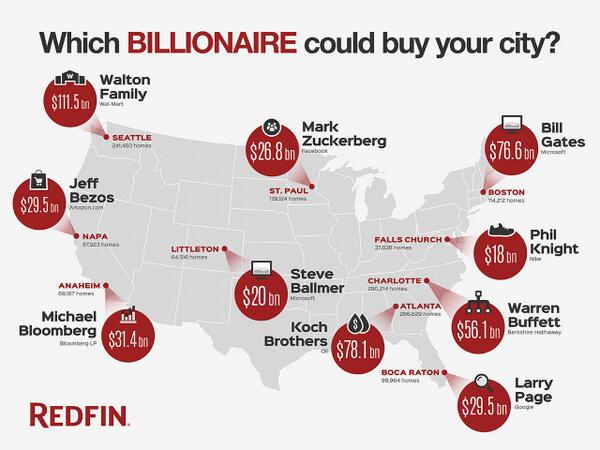

A quaint comparison of what money can buy in today’s market has Bill Gates being able to afford every home in Boston. His $76.6 billion reported by the Washington Post or the $78.4 billion by Forbes seems a pittance when put up against John D. Rockefeller’s peak wealth of $318.3 billion (based on 2007 US dollar). According to your resident commissars over

at MSNBC, "The median net worth of American households hasn't changed much over the past decades, it's about $20,000."

So if Gates decided to purchase all the Beantown houses, whom would he pay for the bricks and mortar? Certainly, most Americans

may think of "their home is their castle", but few actually own a debt free deed to their grand estate.

No wonder the banks and financial institutions, are so fond of placing liens on real property. The

proportional context of looking at individual wealth within the relative value of global wealth is examined in the essay;

It's A "0.6%" World: Who Owns What Of The $223 Trillion

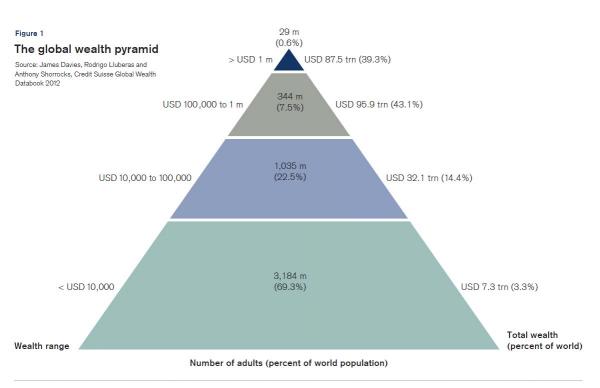

In Global Wealth, seems trite. Zerohedge concludes, "The bottom line: 29 million, or 0.6% of those with any actual assets

under their name, own $87.4 trillion, or 39.3% of all global assets."

Here are the stunning facts: "In 2012, 3.2 billion individuals –

more than two-thirds of the global adult population – have wealth below USD 10,000, and a further one billion (23% of

the adult population) are placed in the USD 10,000–100,000 range. The average wealth holding is modest in the

base and middle segments of the pyramid, total wealth amounts to USD 39 trillion, underlining the potential for new consumer

trends products and for the development of financial services targeted at this often neglected segment. The remaining

373 million adults (8% of the world) have assets exceeding USD 100,000. And then the top of the pyramid: 29 million

US dollar millionaires, a group which contains less than 1% of the world’s adult population, collectively owns nearly

40% of global household wealth. Some 84,500 individuals are worth more than USD 50 million, and 29,000 are worth over

USD 100 million."

After absorbing this macro economic analysis, it should ease the pain

that the stewardship of world wealth is in such trustworthy hands. No need to burden the masses with the weight of building

wealth, when that formula for getting to the top of the financial pyramid, has room for only the few. The expert obelisk creators

never meant for wealth sharing and the tools to construct one’s own prosperity are not included in your capital accumulation

education. The liability of mortgage and property tax obligations to retain your edifice requires regular payments to maintain

the privilege of possession. Ownership is only a conditional wealth asset. Investopedia says 3 Simple Steps To Building Wealth are: "You need to make it. This means that before you can begin

to save or invest, you need to have a long-term source of income that's sufficient enough to have some left over after you've

covered your necessities. You need to save it. Once you have an income that's enough to cover your basics, you need

to develop a proactive savings plan. You need to invest it. Once you've set aside a monthly savings goal, you need to

invest it prudently."

Ordinary consumers do not build great fortunes. The elementary prescription

for "getting ahead" is severely limited in thinking for a world that frequently conducts business as a blood sport.

However, many of the enterprises that carve out a market for their products or services have a distinct edge over the unconnected

entrepreneur. Namely, government directed and controlled startups or collaborated ventures frequently become the commercial

giants of the economy. Here lays the confusion when defining wealth as an accounting device of personal ownership of assets.

In addition, governments are often in the privatization and sale of state assets. The Economists reports that the "IMF estimate that non-financial government assets average 75% of GDP in advanced economies.

In most countries, these are worth more than financial assets (stakes in listed firms, sovereign-wealth and securities holdings

and the like)." Liquid cash flow and high worth individuals, especially with inside track contacts,

are able to cherry pick sweet heart deals. Such opportunities, usually transfers treasure, but infrequently are engines of

new wealth creation. The only guarantee is that money, made or lost depending upon the accounting needs of the vulture predator,

is never an option for the normal hard working taxpayer. Unless people accept the reality that creating and growing

wealth is a noble objective that involves the widespread commerce participation of a merchant class, the outrageous disparity

of the top down wealth stream will widen even more, as the top tier inclusion narrows to fewer mega-billionaires. Global

business encourages transnational conglomerates with commercially identifiable names and logos. When entire economies prevail

under a business plan that eliminates any rival competition, and achieves sole market dominance, the prospects to advance

the individual wealth ledger of the average person diminishes. An opportunistic society can only exist when independent

business flourishes. Government bureaucrats and corporate technocrats oppose an unambiguous free market economy. As the map of the über-billionaires illustrates, their checkbook could swallow up entire cities. However, digesting,

let alone growing communities into quality environments for future generations, takes an active involvement in the wealth

building process that rewards contributing players. Without a widespread populace practicing mutually

beneficial business transactions, the capacity to achieve the skills necessary to compete successfully, will never develop.

Instead of making money, saving money and investing money, learn the aptitude of business as a lifelong endeavor. The

poor will always be scraping the bottom, until they learn how to advance their abilities for the betterment of their own families.

The alternative to greater concentration of wealth is to initiate a viable substitute to the financial stranglehold that furthers

the appetites of egomaniacs like the character, Bretton James in the movie Money Never Sleeps. In the end, the true individual wealth that anyone can attain is the sincerity

and moral substance of his or her own character. Money may not snooze from making more cash, but is only a means to elevate

living a life worth lived. In such a quest, the super rich may have a net worth equivalent to one’s

property, but they can never afford the essence of your family or measure of your community. James Hall – June

11, 2014

Subscribe to the BATR Realpolitik Newsletter

Discuss or comment about this essay on the BATR Forum

|