|

College

Education Economics

For

previous generations, the dream of a college education for their children was a primary motivation. Gaining access to the

teachings of higher learning is certainly a laudable objective. While this goal still holds true, there is a systemic disconnect

from attending institutions that cost a king’s ransom and having marketable skills to earn a generous income in the

post industrial economy. When government employment becomes the most sought after occupation, the economic future of the country

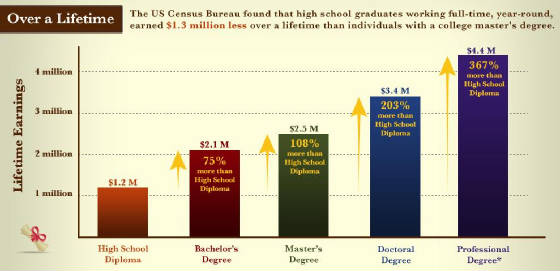

sinks into deep decline. The old correlation with the higher your education, the greater your income, is no more. Proof for such a conclusion is provided by the following list, Shocking Facts About Student

Debt And The Great College Education Scam. 1) Americans

now owe more than $875 billion on student loans, which is more than the total amount that Americans owe on their credit cards 2) Since 1982, the cost of medical care in the United States has gone up over 200% but that

is nothing compared to the cost of college tuition which has gone up by more than 400% 3)

The unemployment rate for college graduates under the age of 25 is over 9% 4)

There are about two million recent college graduates that are currently unemployed 5)

There are about two million recent college graduates that are currently unemployed 6)

In the United States today, 317,000 waiters and waitresses have college degrees 7)

The Project on Student Debt estimates that 206,000 Americans graduated from college with more than $40,000 in student loan

debt during 2008 8) In the United States today, 24.5 percent of all retail

sales persons have a college degree 9) Total student loan debt in the

United States is now increasing at a rate of approximately $2,853.88 per second 10)

Total student loan debt in the United States is now increasing at a rate of approximately $2,853.88 per second 11) There are 365,000 cashiers in the United States today that have college degrees 12) Starting salaries for college graduates across the United States are down in 2010 In 1992, there were 5.1 million "underemployed" college graduates in the United

States. In 2008, there were 17 million "underemployed" college graduates in the United States 13) In the United States today, over 18,000 parking lot attendants have college degrees 14) Federal statistics reveal that only 36 percent of the full-time students who began college

in 2001 received a bachelor's degree within four years 15) According

to a recent survey by Twentysomething Inc., a staggering 85 percent of college seniors planned to move back home after graduation

last May

The incurring debt that saddles students is unsustainable.

The Business Insider reports in The $100 Billion Student

Debt Bubble May Finally Blow, "As it stands, no matter how deep borrowers find themselves buried

in student loan debt, they can't discharge it in bankruptcy court – all because it doesn't qualify as an "undue

hardship." As the economy struggles and minimum wage employment becomes the norm, how can attending college retain

its glow? The

cost of college is not uniform. The College Board reports, "In

2011-12, 44 percent of all full-time undergraduate college students attend a four-year college that has published charges

of less than $9,000 per year for tuition and fees. At the other end of

the spectrum, approximately 28 percent of full-time private nonprofit four-year college students are enrolled in institutions

charging $36,000 or more yearly in tuition and fees."

The

value of attending a prestigious private institution especially has a real harsh impact, if student loans are necessary to

pay for that experience. "College tuition increases about 8 percent annually or doubles about every nine years, according

to FinAid.org." The continual increase

in college costs is the persistent dilemma that challenges the ultimate benefit of attending university. America has become a society

for elites. The embodiment of success, sold under the mantra of achieving degrees of higher learning, no longer works. For

all the "so called" professionals that act as gatekeepers for the establishment, the rewards from the system flow,

as long as their loyalty, to the corporatist institutions remains. However, for all the ordinary college graduates that seek

a better life through hard work, the prospect of entering the inner circles of the "golden parachute" is

elusive. Earning your way to the top may motivate the most competitive

of type A personalities, but the survival of the most ruthless is no standard for a free society. The wisdom that college

is supposed to share is not valued much in global business. Some will

conclude that only practical disciplines like engineering, accounting or medicine have pragmatic worth. Nevertheless, the

systematic dismantling of the domestic economy is intrinsically responsible for the lost opportunities that can benefit from

a work force of college graduates. Look no further than to the study of law for a primary reason for the sharp delineation

in the lower ing of living standards. The economics of college do not

work for most students because the costs of the educational electives are void of entrepreneurial content. Transacting business

commerce is still the fundamental activity in earning a living. As with any economic deal, both parties need to come away

from the undertaking with a sense of satisfaction. Where is the gratification from flipping burgers in order to make your

student loan payment? The knowledge gained from the university exposure

of classic studies is invaluable in the life of any adult. However, the cruel costs many colleges charge for that experience,

have more to do with inflated institutional egos, than teaching developing intellectual minds. As

long as college graduates are prime victims of declining middle class prospects, the indebtedness of tuition bills will burden

their futures. The solution is to grow a domestic economy based upon independence in manufacturing and self-sufficiency. Attending

college on loans is a very bad decision. The money spent for a useless degree is better spent on buying or starting a business.

James Hall – March 14, 2012

|